Household debt has increased by 2.75 trillion since the start of the pandemic in 2019. Three years later, people across the globe are fighting record-breaking inflation. And in the face of unprecedented financial challenges, there has never been a better time to strengthen your personal finance skills and take control of your financial future. With that in mind, we’ve gathered a list of the top online personal finance courses to help you navigate the confusing world of money management.

Whether you’re looking to eliminate debt, create a budget, or make smarter financial decisions, online personal finance courses can give you the knowledge and tools you need to meet your goals. By enrolling in one or more of these courses, you’ll learn valuable financial planning, investment, and saving strategies. No matter how much money, time, or experience you have, there is a course for you. Let’s dive in!

Click the following links to jump ahead.

8 free personal finance courses

- Finance for Everyone: Smart Tools for Decision-Making

- Life Skills Personal Finance

- Introduction to Managing Your Personal Finance Debts

- Behavioral Finance

- Introduction to Personal Financial Planning

- Personal & Family Financial Planning

- Personal Finance for Self-Reliance

- Money Wise Financial Course

8 paid personal finance courses

- Ramsey+

- My Fab Finance Bootcamp

- Suze Orman’s Personal Finance Online Course

- Broward College Personal Finance

- Personal Finance for Artists & Freelancers

- Start Here

- 2023 Stock Market Class: Learn to Invest For Your Future

- Managing Your Personal Finances

8 free personal finance courses

Money matters! So we’re starting this list off with the best free online personal finance courses we’ve found — helping you reach your goals without adding a line to your budget.

1. Finance for Everyone: Smart Tools for Decision-Making

Course creator: University of Michigan

Duration: 6 weeks, 5-6 hours per week

Price: Free

Description: Whether you’re looking to learn about investing, deciding whether to attend college, or considering saving up to purchase a home, this top-rated financial course is truly designed for everyone. In this seven-module course, students can expect to learn about stocks and bonds, financial literacy basics, and simple and advanced applications (like the fundamentals of a loan or how to save for college).

The class is free to audit, so you can access the course content at no cost. If you’d like to participate in the quizzes and exams or receive a certificate of completion, you must pay for the $49 upgrade.

2. Life Skills Personal Finance

Course creator: Khan Academy

Duration: Self-paced

Price: Free

Description: Like Finance for Everyone, this course appeals to the everyday consumer. It addresses financial situations for individuals, families, college students, those in debt, and those looking to invest. The course includes 10 units, each featuring written and video content. The sister course to Personal Finance, Financial Literacy, is also free and takes this learning one step further with interactive activities and graded assessments.

Students can expect to learn about saving and investment strategies, budgeting, interest, credit and loan debt, renting vs. buying, buying vs. leasing, how to pay for college, and taxes. While this course is completely free and easy to access, there isn’t an option to receive a certificate of completion.

3. Introduction to Managing Your Personal Finance Debts

Course creator: Christine Williams

Duration: 1-3 hours

Price: Free

Description: Introduction to Managing Your Personal Finance Debts is one of the top-rated free personal finance classes on the Alison platform. It’s designed for those looking to learn about, avoid, and escape debt. Perfect for students with limited learning time, the course is brief and only requires a few hours of commitment.

The course consists of two units, seven lessons, and one final assessment. Students can expect to learn how to set up a debt spreadsheet, contact creditors and negotiate various terms, prioritize debts for strategic repayment, and implement an emergency debt elimination plan. Unlike many other free courses, this course will award a certificate of completion and is Continuing Professional Development (CPD) certified.

4. Behavioral Finance

Course creator: Duke University

Duration: 3 weeks, 1-3 hours per week

Price: Free

Description: Duke’s Behavioral Finance course is unlike any other personal finance class. This course is for students looking to understand the why behind their financial decisions. It’s a great choice for people advising others on finance management or for people looking to make better financial decisions. Students can expect to learn about the psychology behind poor decision-making in investment choices, budgeting, or purchasing decisions.

Each of the three modules features a quiz at the end. The free course gives students access to all of the learning material. However, it doesn’t include a certificate of completion. For that, you’ll need to pay the $49 optional upgrade fee.

5. Introduction to Personal Financial Planning

Course creator: Indiana University

Duration: 4 weeks

Price: Free

Description: This course is designed with the general student in mind; it’s great for those looking to strengthen their understanding of personal finance and financial planning. Students can expect to learn budgeting, record keeping, the Time Value of Money (TVM), tax planning, wealth building, and other financial planning essentials.

While the course is self-paced, it’s designed to take four weeks with four modules total, one for each week. Each unit will include video and written content as well. Like other edX courses, access to course content is free, but graded assignments, exams, and the certificate of completion will cost extra. For this course, those add-ons will cost you $199.

6. Personal & Family Financial Planning

Course creator: University of Florida

Duration: 9 weeks, 1-2 hours each week

Price: Free

Description: Students can expect to learn how to read financial statements, use financial tools, create budgets, manage taxes, build and maintain good credit, invest, and manage financial risks for long-term financial health.

Personal & Family Financial Planning is spaced out over nine weeks, with eight modules and one bonus module. These modules include readings, videos, and practice exercises. However, to access assessments and earn a certification of completion, students will need to upgrade to the $49 option. Otherwise, they’ll only have access to course content.

7. Personal Finance for Self-Reliance

Course creator: Brigham Young University

Duration: Self-paced

Price: Free

Description: As part of a larger Self-Reliance Services program, this course is published by BYU, which is a religious university owned and operated by The Church of Jesus Christ of Latter-day Saints (LDS Church). For that reason, this could be a great course for those interested in faith-based financial education. Students can expect to learn about individual and family finances, budgeting, preparing for emergencies, investing for the future, and getting out of debt.

This course consists of 12 chapters, not including the introductory chapter. Each chapter includes articles, and all but the final chapter include video content. You can also download an engaging 218-page manual for free, which includes additional content, resources, and interactive worksheets. Students won’t receive a certificate of completion but are encouraged to join local communities for a cohort-style experience.

8. Money Wise Financial Course

Course creator: Brigham Young University

Duration: Self-paced

Price: Free

Description: Similar to Personal Finance for Self-Reliance, this course teaches many of the same financial fundamentals but focuses more on individuals and less on families. Also published by BYU, this course heavily emphasizes faith-based decision-making but is welcoming and consumable by anyone interested in learning about personal finance.

Students can expect to learn about financial principles, budgeting, saving, investing, taxes, avoiding credit and debt, and how to make major life purchases like buying a home, life insurance, and a car. This course does not include a certificate of completion but offers tons of downloadables. Students can download a 327-page manual with interactive content and articles, three interactive packets, and one outline. Each chapter also includes a downloadable Powerpoint.

8 paid personal finance courses

Next, we’ve compiled some of the best paid personal finance courses available. While free can be great, in many cases paid courses offer a more comprehensive curriculum, structured learning, established experts and instructors, personalized feedback, certificates, and additional resources.

Free courses can be an excellent starting point, but the right paid course can help you reach your savings, investment, or debt elimination goals faster, which may cover learning costs in no time.

1. Ramsey+

Course creator: Dave Ramsey

Duration: Ongoing

Price: $129.99 per year

Description: Consistently rated among the top personal financial planning courses, Ramsey+ is more of a platform than a single course. It provides users access to budgeting tools, online courses, and expert advice to help them manage their money, eliminate debt, and build wealth.

Dave Ramsey’s flagship course, Financial Peace University, is included in the platform subscription and features nine lessons over nine weeks. You’ll receive an editable digital workbook, interactive tools, and calculators. In addition to the course, you’ll also receive access to his budgeting app, EveryDollar. And as if that wasn’t enough, the platform is regularly updated with new content and live streams.

At only $129.99 for 12 months of access, this is an incredibly comprehensive offering. Still, if it’s a bit steep for your budget, you can also opt for a three-month plan at $59.99 or a six-month plan at $99.99.

2. My Fab Finance Bootcamp

Course Creator: Tonya Rapley, My Fab Finance

Duration: 8 weeks

Price: $397

Description: Tonya Rapley, founder of My Fab Finance and Think In Color speaker, created the Fab Finance Bootcamp for women looking to achieve financial security. Students can expect to start the course with a financial audit, followed by learning about long-term financial planning, understanding your financial values, budgeting, saving, credit strategies, eliminating debt, and investing.

The course is spaced out over a comfortable eight-week period. Students will also receive custom feedback and support with weekly office hours and a designated space for questions. The tenth module in the course features bonus content on topics like how to buy a car, travel without breaking the bank, and invest. If the $397 price tag is out of your budget, Tonya also offers a scaled-down offering called the Essential Financial Courses Special Bundle at only $47.

3. Suze Orman’s Personal Finance Online Course

Course creator: Suze Orman

Duration: Self-paced

Price: $54

Description: Suze’s personal finance course is designed for families and individuals of any age. Students will start by seriously evaluating their financial situation and move on to a carefully formulated series of lessons. She’ll take you through paying down your debt, saving for retirement, investing, and saving for large purchases like a home or car. You’ll also learn about student loans and home and life insurance.

You’ll have indefinite access to the course and gain access to a private online community, which is great for seeking support or asking questions. This course is an excellent choice for students needing actionable advice and a clear set of steps at a low cost.

4. Broward College Personal Finance

Course creator: Broward College

Duration: 6 weeks

Price: $135

Description: Mastering Personal Financial Planning is an online course designed to equip you with the knowledge and skills necessary for effective, long-term personal financial planning. This comprehensive course covers various topics, from setting clear financial goals and preparing for retirement to making smart investment choices and improving credit scores.

Key topics covered include budgeting, wise borrowing and investing, insurance decision-making, retirement planning, tax preparation, and major purchases. In addition, the course will teach you the essentials of household bookkeeping, recordkeeping requirements, and more. By the end of the course, you’ll have a completed retirement savings plan, be able to make informed decisions on investments, and manage your personal finances effectively for a more secure financial future.

5. Personal Finance for Artists & Freelancers

Course creator: Galia Gichon

Duration: 15 hours

Price: $49

Description: Galia is a personal finance expert with an impressive 19 years of experience in financial services. She dives deep into personal finance in this course, which includes 30 video lessons amounting to almost 15 hours of content. Students will start by assessing their current financial health, followed by creating financial goals, looking at their credit and how to improve it, learning strategies to grow their savings, and understanding how to plan for retirement.

Galia shares actionable advice and breaks things down to just 30 minutes of action per week. Downloadables include three presentations, a monthly and weekly spending worksheet, a budget worksheet, a mutual fund checklist, and more. This course is an excellent choice for artists and freelancers who primarily enjoy video content and are looking to dive deep into a wide range of personal finance topics.

6. Start Here

Course creator: Haley Sacks

Duration: Self-paced

Price: $150

Description: Haley Sacks, also known as Mrs. Dow Jones on social media, has grown a large following by sharing personal finance tips online. In recent years she was also featured in Fortune’s 40 Under 40. Her aptly named course, “Start Here,” is designed for any beginner who wants to take control of their personal finances. However, if you’re unfamiliar with her social media content, the course has a sassy-comical edge that strongly appeals to her Millennial and Gen Z audience.

Like the course title implies, students will begin their course by evaluating their current financial situation. Then, they’ll set goals with actionable steps, create a budget, and implement their new financial plans. Included in the course is a Google Sheet called “The Money Book.” This was Haley’s original money management system and has custom formulas you can use throughout the course. Start Here is perfect for people who want to laugh while they learn about interest and, as she puts it, “become your own trust fund.”

7. 2023 Stock Market Class: Learn to Invest For Your Future

Course creator: Steve Chen

Duration: Self-paced

Price: $157 a month or $1,997 annually

Description: Steve’s online finance course is for students with basic financial literacy skills looking for advanced personal finance, specifically stock market investing. Drawing inspiration from the F.I.R.E. (financial independence, retire early) movement, his goal is to teach others how to build wealth so they can live comfortably in the future.

The course features over 30 videos and includes quizzes, a community FAQ board, and a Discord Community for group discussions. Students will also have access to Steve and his team for support and will receive a weekly breakdown of what Steve has invested in that week. At the high price of almost $2,000 annually, this truly is catered to those ready to take the next step in their personal finance journey and learn how to invest, trade, and build wealth.

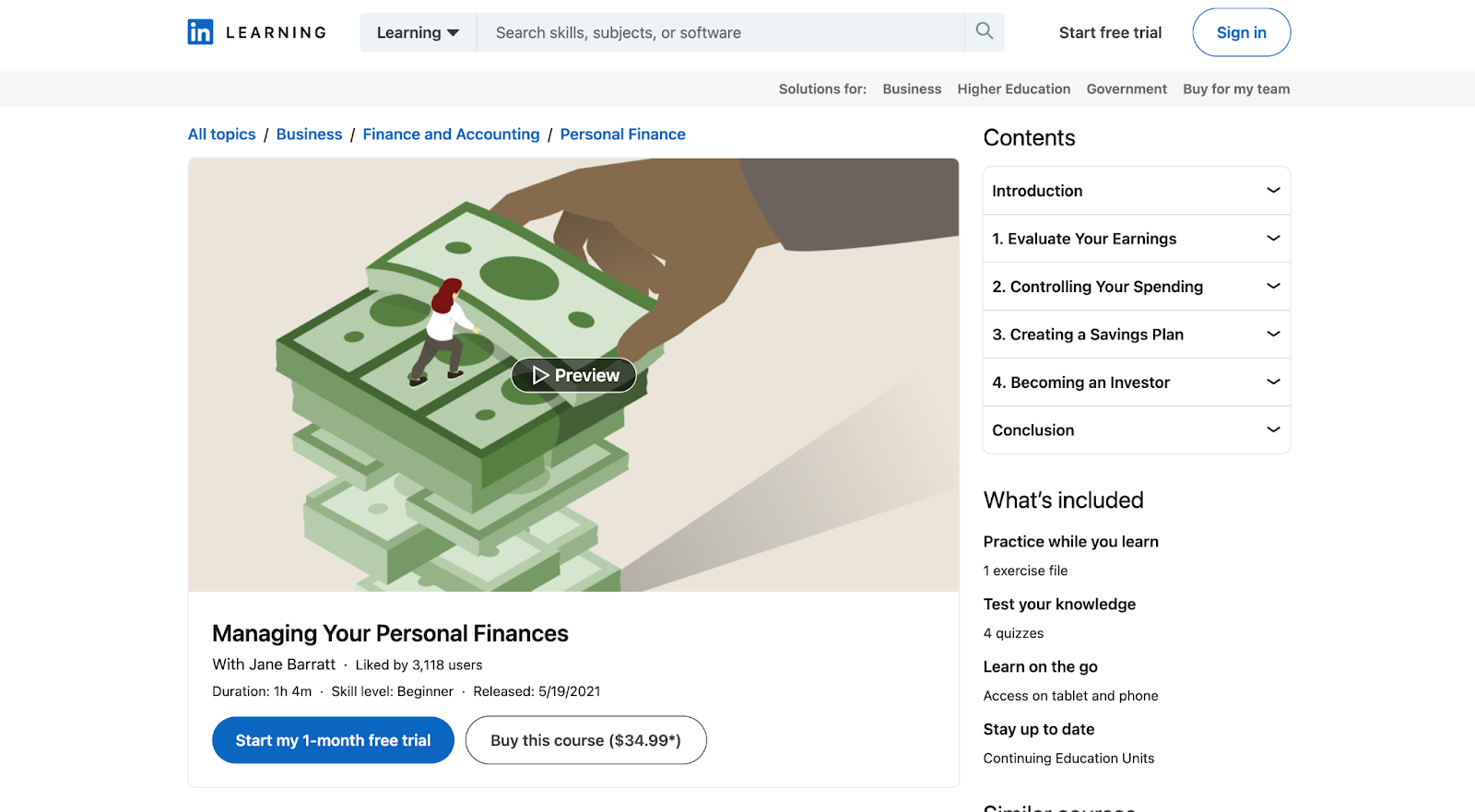

8. Managing Your Personal Finances

Course creator: Jane Barratt

Duration: 1 hour

Price: Requires a subscription; $39.99 a month or annually $19.99 a month

Description: Managing Your Personal Finances is an online course designed for beginners looking to learn personal finance fundamentals. They can expect to learn about earning money, saving, growing money through investment, and adapting their assets over time.

The course includes four modules, 22 videos, and four quizzes. Students will also earn a certificate of completion that can be shared directly on their LinkedIn profile. With 1,600 reviews and counting, students are overwhelmingly satisfied with what this course offers.

Sign up for the best personal finance courses today

Regardless of your financial situation, personal finance courses can help you make better investment, savings, or financial management decisions. By investing time, and sometimes money, in your financial education, you’ll be able to find the support you need and reach your financial goals quicker. So don’t wait—get started today!

Interested in sharing and monetizing your personal finance knowledge with the world? Try Thinkific free today.